A lot is being discussed about inflation, specifically if inflation will be temporary and short-lived or if inflation will be permanent with longer-term effects.

The Federal Reserve Chairman, Mr. Jerome Powell has been adamant in public hearings and interviews that, in the view of the Fed’s Board of Governors, most of the inflationary pressures are of short-term nature citing (see here) side issues that have led to supply shortages and caused prices to temporarily increase. Items such as lumber and automobiles have been quoted as some of the culprits of the ordeal.

Furthermore, members of the Federal Reserve have implied that as companies recover from the negative effects of COVID, such as limited labor, cuts in production schedules and supply chain bottlenecks, supply should reach pre-pandemic levels, which should translate in better demand-supply equilibrium and consequently a reduction in prices.

I beg to differ. Although prices may decrease on certain items as COVID-related pressures subdue, I estimate that we will experience some lasting effects on commonly used and purchased goods. A more pragmatic approach reveals a different story.

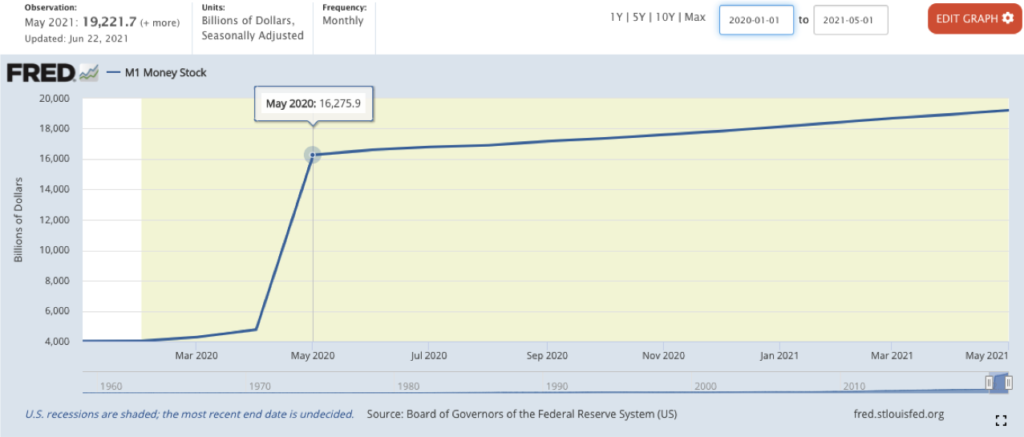

One of the the most unforeseen effects of the pandemic has to be the meteoric rise of wages and salaries as the workforce has been flooded with Federal economic aid and the economy is flush with cash. Following the most extreme monetary expansion seen in our lifetime (to the tune of $15T), employers have been scrambling to attract the talent necessary to increase production to meet the pent-up demand for products and services.

Restaurants, a main staple of the service industry, have been rocked by the lack of people interested in such jobs. Just recently, a local Restaurant Association coordinated a job fair, which advertised that more than 5,000 jobs would be available for immediate hire. To the organizer’s dismay only 250 – 300 people showed up, of which about 70-80 came out with job offers. This dire situation has forced employers to increase salaries, benefits and perks to attract the talent needed. Anyone would be remiss to believe that such costs will not be passed on to the consumer – indefinitely.

I’m an entrepreneur and had to grapple with such challenges myself. We spent more than 6 months aggressively seeking employees with no luck. As a matter of life or death we had to aggressively increase the salaries of the employees we had on payroll to ensure we would retain them (failing to do so would have been catastrophic to our business). Furthermore we had to increase the base pay for new hires in order to ensure we could attract the talent we needed. In all, such changes translated into a 20% to 22% increase in our payroll expense. There is no way anyone can argue that such expenses are temporary – there is no going back. As much as I feel great that we can offer our employees competitive salaries and a means for a dignified life, eventually the consumer will bear the brunt of the weight.

Similar to the case of salaries and wages, there are many other examples (rental costs, transportation, etc.) that can be brought to the front for close examination. However, in keeping faithful to the title of this post, I will keep it brief and not expand any further.

Although, I respect the Fed for what it does and the bold actions it has taken to save the economy, a boots-on-the-ground view of the situation provides a very different picture. Only time will tell.

Update: 7/31/21

After the July 27-28, 2021 FOMC meeting, the Fed Chair delivered a message summarizing the key takeaways of the meeting. In the Q&A section that followed a reporter asked about what the Fed meant by “transitory” when referring to inflation. Mr. Powell’s response was that “transitory” means that the inflation will not continue the pace that it is currently in, in other words they do not expect a continued increase at the current rate. Mr. Powell indicated that by “transitory” they did not mean that price increases would revert to pre-pandemic levels but rather that the trend in such increased would not be sustained.

Good job. Thanks!